Tail Sets

Tail set labels are a classification labeling technique introduced in the following paper: Nonlinear support vector machines can systematically identify stocks with high and low future returns, by Huerta, R., Corbacho, F. and Elkan, C.

A tail set is defined to be a group of assets whose return is in the highest or lowest quantile, for example the highest or lowest 5%, for a given timestamp. The returns may be volatility-adjusted.

A classification model is then fit using these labels to determine which stocks to buy and sell, for a long / short portfolio.

We label the y variable using the tail set labeling technique, which makes up the positive and negative (1, -1) classes of the training data. The original paper investigates the performance of 3 types of metrics on which the tail sets are built:

Real returns

-

Residual alpha after regression on the sector index

Volatility-adjusted returns

For our particular implementation, we have focused on the volatility-adjusted returns.

Metric: Volatility-Adjusted Returns

The formula for the volatility-adjusted returns are as follows:

Where \(R(t-t',t)\) is the return for the asset, in our case we make use of daily (single period) returns, and \(vol(t-1)\) is a measure for volatility on daily returns. We provide two implementations for estimations of volatility, first the exponential moving average of the mean absolute returns, and second the traditional standard deviation. (The paper suggests a 180 day window period.)

To quote the paper: “Huffman and Moll (2011) show that risk measured as the mean absolute deviation has more explanatory power for future expected returns than standard deviation.”

Creating Tail Sets

Once the volatility adjusted returns have been applied to the DataFrame of prices we then loop over each timestamp and group the assets into quantiles. The user inputs the number of quantiles desired using the n_bins input, and the highest and lowest quantiles compose positive and negative tail sets, respectively. For example, if the highest and lowest octile are desired, then n_bins would be 8.

Its important to note that we drop the 0 labels (for a given timestamp) and only train the model assets that made it into the tail sets.

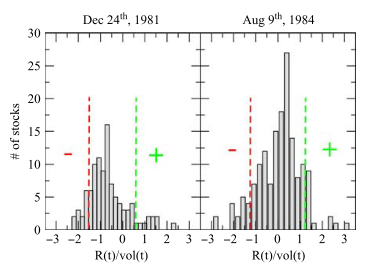

The following figure from the paper shows the distribution of the 91-day volatility-adjusted returns for the industrials sector.

The positive tail sets are the 10% most positive volatility-adjusted returns, and the negative tail sets are the 10% most negative. The vertical dotted lines represent the decile cut. The + and − regions are the ones used for model training.

How to use these labels in practice?

The tail set labels from the code above returns the names of the assets which should be labeled with a positive or negative label. Its important to note that the model you would develop is a many to one model, in that it has many x variables and only one y variable. The model is a binary classifier.

The model is trained on the training data and then used to score every security in the test data (on a given day). Example: On December 1st 2019, the strategy needs to rebalance its positions, we score all 100 securities in our tradable universe and then rank the outputs in a top down fashion. We form a long / short portfolio by going long the top 10 stocks and short the bottom 10 (equally weighted). We then hold the position to the next rebalance date.

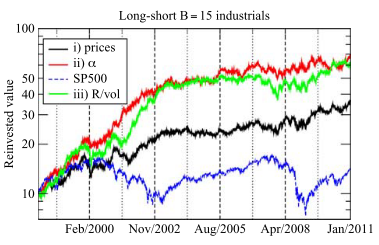

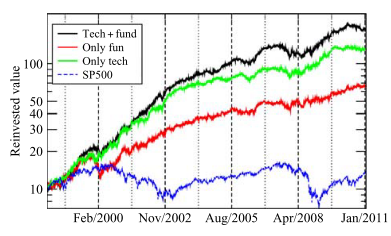

The paper provides the following investment performance:

Implementation

Warning

The Tail Set labels are for the current day! In order to use them as a labeling technique you need to lag them so that they can be forward looking. We

recommend using the pandas DataFrames

df.lag(1)

method.

- class TailSetLabels(prices, n_bins, vol_adj=None, window=None)

-

Tail set labels are a classification labeling technique introduced in the following paper: Nonlinear support vector machines can systematically identify stocks with high and low future returns. Algorithmic Finance, 2(1), pp.45-58.

A tail set is defined to be a group of stocks whose volatility-adjusted return is in the highest or lowest quantile, for example the highest or lowest 5%.

A classification model is then fit using these labels to determine which stocks to buy and sell in a long / short portfolio.

- __init__(prices, n_bins, vol_adj=None, window=None)

-

Initialize.

- Parameters:

-

-

prices – (pd.DataFrame) Asset prices.

-

n_bins – (int) Number of bins to determine the quantiles for defining the tail sets. The top and bottom quantiles are considered to be the positive and negative tail sets, respectively.

-

vol_adj – (str) Whether to take volatility adjusted returns. Allowable inputs are

None,mean_abs_dev, andstdev. -

window – (int) Window period used in the calculation of the volatility adjusted returns, if vol_adj is not None. Has no impact if vol_adj is None.

-

- __weakref__

-

list of weak references to the object (if defined)

- get_tail_sets()

-

Computes the tail sets (positive and negative) and then returns a tuple with 3 elements, positive set, negative set, full matrix set.

The positive and negative sets are each a series of lists with the names of the securities that fall within each set at a specific timestamp.

For the full matrix a value of 1 indicates the volatility adjusted returns were in the top quantile, a value of -1 for the bottom quantile.

- Returns:

-

(tuple) Positive set, negative set, full matrix set.

Example

Below is an example on how to create the positive, negative, and full matrix Tail Sets.

# Import packages

import yfinance as yf

# Import MlFinLab tools

from mlfinlab.labeling.tail_sets import TailSetLabels

# Import price data.

tickers = "AAPL MSFT AMZN GOOG"

data = yf.download(tickers, start="2010-01-01", end="2022-01-01")["Adj Close"]

# Create tail set labels

labels = TailSetLabels(prices=data, n_bins=4, vol_adj="mean_abs_dev", window=180)

pos_set, neg_set, matrix_set = labels.get_tail_sets()

# Lag the labels to make them forward looking

pos_set = pos_set.shift(-1)

neg_set = neg_set.shift(-1)

matrix_set = matrix_set.shift(-1)

Research Notebook

The following research notebooks can be used to better understand the Tail Set labeling technique.

Tail Set Labels Example