Note

The following implementation and documentation closely follow the work of Gautier Marti: CorrGAN: Sampling Realistic Financial Correlation Matrices using Generative Adversarial Networks.

And the work of Donnat, P., Marti, G. and Very, P: Toward a generic representation of random variables for machine learning.

Data Verification

Data verification for synthetic data is needed to confirm if it shares some properties of the original data. Being able to examine and validate synthetically generated data is critical to building more accurate systems. Without verification, we would operate on data that might not have any significance in the real world. We present several methods to examine the properties of this type of data.

Note

Underlying Literature

The following sources elaborate extensively on the topic:

-

CorrGAN: Sampling Realistic Financial Correlation Matrices using Generative Adversarial Networks by Gautier Marti.

-

Toward a generic representation of random variables for machine learning by Donnat, P., Marti, G. and Very, P.

Stylized Factors of Correlation Matrices

Following the work of Gautier Marti in CorrGAN, we provide function to plot and verify a synthetic matrix has the 6 stylized facts of empirical correlation matrices.

The stylized facts are:

-

Distribution of pairwise correlations is significantly shifted to the positive.

-

Eigenvalues follow the Marchenko-Pastur distribution, but for a very large first eigenvalue (the market).

-

Eigenvalues follow the Marchenko-Pastur distribution, but for a couple of other large eigenvalues (industries).

-

Perron-Frobenius property (first eigenvector has positive entries).

Hierarchical structure of correlations.

-

Scale-free property of the corresponding Minimum Spanning Tree (MST).

Implementation

- plot_stylized_facts(emp_mats, gen_mats, n_hist=100)

-

Plots the following stylized facts for comparison between empirical and generated correlation matrices:

-

Distribution of pairwise correlations is significantly shifted to the positive.

2. Eigenvalues follow the Marchenko-Pastur distribution, but for a very large first eigenvalue (the market).

3. Eigenvalues follow the Marchenko-Pastur distribution, but for a couple of other large eigenvalues (industries).

-

Perron-Frobenius property (first eigenvector has positive entries).

-

Hierarchical structure of correlations.

-

Scale-free property of the corresponding Minimum Spanning Tree (MST).

It is reproduced with modifications from the following blog post: Marti, G. (2020) TF 2.0 DCGAN for 100x100 financial correlation matrices [Online]. Available at: https://marti.ai/ml/2019/10/13/tf-dcgan-financial-correlation-matrices.html. (Accessed: 17 Aug 2020)

- Parameters:

-

-

emp_mats – (np.array) Empirical correlation matrices. Has shape (n_samples_a, dim_a, dim_a)

-

gen_mats – (np.array) Generated correlation matrices. Has shape (n_samples_b, dim_b, dim_b)

-

n_hist – (int) Number of bins for histogram plots. (100 by default).

-

-

- plot_pairwise_dist(emp_mats, gen_mats, n_hist=100)

-

Plots the following stylized facts for comparison between empirical and generated correlation matrices:

-

Distribution of pairwise correlations is significantly shifted to the positive.

It is reproduced with modifications from the following blog post: Marti, G. (2020) TF 2.0 DCGAN for 100x100 financial correlation matrices [Online]. Available at: https://marti.ai/ml/2019/10/13/tf-dcgan-financial-correlation-matrices.html. (Accessed: 17 Aug 2020)

- Parameters:

-

-

emp_mats – (np.array) Empirical correlation matrices. Has shape (n_samples_a, dim_a, dim_a)

-

gen_mats – (np.array) Generated correlation matrices. Has shape (n_samples_b, dim_b, dim_b)

-

n_hist – (int) Number of bins for histogram plots. (100 by default).

-

- Returns:

-

(plt.Axes) Figure’s axes.

-

- plot_eigenvalues(emp_mats, gen_mats, n_hist=100)

-

Plots the following stylized facts for comparison between empirical and generated correlation matrices:

-

Eigenvalues follow the Marchenko-Pastur distribution, but for a very large first eigenvalue (the market).

-

Eigenvalues follow the Marchenko-Pastur distribution, but for a couple of other large eigenvalues (industries).

It is reproduced with modifications from the following blog post: Marti, G. (2020) TF 2.0 DCGAN for 100x100 financial correlation matrices [Online]. Available at: https://marti.ai/ml/2019/10/13/tf-dcgan-financial-correlation-matrices.html. (Accessed: 17 Aug 2020)

- Parameters:

-

-

emp_mats – (np.array) Empirical correlation matrices. Has shape (n_samples_a, dim_a, dim_a)

-

gen_mats – (np.array) Generated correlation matrices. Has shape (n_samples_b, dim_b, dim_b)

-

n_hist – (int) Number of bins for histogram plots. (100 by default).

-

- Returns:

-

(plt.Axes) Figure’s axes.

-

- plot_eigenvectors(emp_mats, gen_mats, n_hist=100)

-

Plots the following stylized facts for comparison between empirical and generated correlation matrices:

-

Perron-Frobenius property (first eigenvector has positive entries).

It is reproduced with modifications from the following blog post: Marti, G. (2020) TF 2.0 DCGAN for 100x100 financial correlation matrices [Online]. Available at: https://marti.ai/ml/2019/10/13/tf-dcgan-financial-correlation-matrices.html. (Accessed: 17 Aug 2020)

- Parameters:

-

-

emp_mats – (np.array) Empirical correlation matrices. Has shape (n_samples_a, dim_a, dim_a)

-

gen_mats – (np.array) Generated correlation matrices. Has shape (n_samples_b, dim_b, dim_b)

-

n_hist – (int) Number of bins for histogram plots. (100 by default).

-

- Returns:

-

(plt.Axes) Figure’s axes.

-

- plot_hierarchical_structure(emp_mats, gen_mats)

-

Plots the following stylized facts for comparison between empirical and generated correlation matrices:

-

Hierarchical structure of correlations.

It is reproduced with modifications from the following blog post: Marti, G. (2020) TF 2.0 DCGAN for 100x100 financial correlation matrices [Online]. Available at: https://marti.ai/ml/2019/10/13/tf-dcgan-financial-correlation-matrices.html. (Accessed: 17 Aug 2020)

- Parameters:

-

-

emp_mats – (np.array) Empirical correlation matrices. Has shape (n_samples_a, dim_a, dim_a)

-

gen_mats – (np.array) Generated correlation matrices. Has shape (n_samples_b, dim_b, dim_b)

-

- Returns:

-

(tuple) Figures’ axes.

-

- plot_mst_degree_count(emp_mats, gen_mats)

-

Plots all the following stylized facts for comparison between empirical and generated correlation matrices:

-

Scale-free property of the corresponding Minimum Spanning Tree (MST).

It is reproduced with modifications from the following blog post: Marti, G. (2020) TF 2.0 DCGAN for 100x100 financial correlation matrices [Online]. Available at: https://marti.ai/ml/2019/10/13/tf-dcgan-financial-correlation-matrices.html. (Accessed: 17 Aug 2020)

- Parameters:

-

-

emp_mats – (np.array) Empirical correlation matrices. Has shape (n_samples_a, dim_a, dim_a)

-

gen_mats – (np.array) Generated correlation matrices. Has shape (n_samples_b, dim_b, dim_b)

-

- Returns:

-

(plt.Axes) Figure’s axes.

-

Example

import yfinance as yf

from mlfinlab.data_generation.corrgan import sample_from_corrgan

from mlfinlab.data_generation.data_verification import plot_stylized_facts

# Download stock data from yahoo finance

dimensions = 3

prices = yf.download(tickers=" ".join(["AAPL", "MSFT", "AMZN"]), period='1y')['Close']

# Calculate correlation matrices

prices = prices.pct_change()

rolling_corr = prices.rolling(252, min_periods=252//2).corr().dropna()

# Generate same quantity of data from CorrGAN

num_samples = len(rolling_corr.index.get_level_values(0).unique())

corrgan_mats = sample_from_corrgan(model_loc="corrgan_models",

dim=dimensions,

n_samples=num_samples)

# Transform from pandas to numpy array

empirical_mats = []

for date, corr_mat in rolling_corr.groupby(level=0):

empirical_mats.append(corr_mat.values)

empirical_mats = np.array(empirical_mats)

# Plot all stylized facts

plot_stylized_facts(empirical_mats, corrgan_mats)

Time Series Codependence Visualization

Note

The correlated random walks time series generation and GNPR codependence measure approaches are fully explored in our Correlated Random Walks and Codependence by Marti sections.

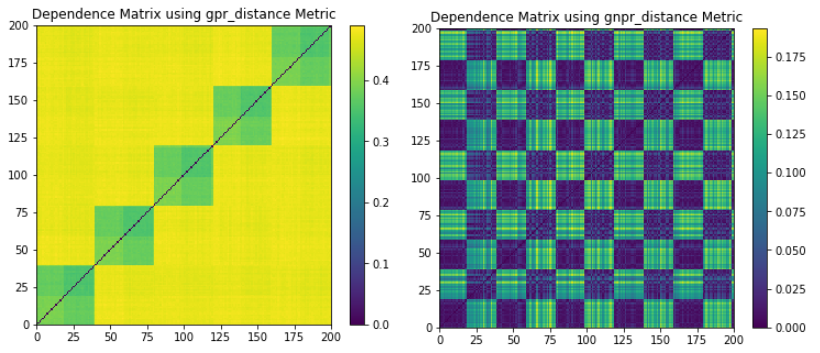

Following the work of Donnat, Marti, and Very (2016) we provide a method to plot the GNPR codependence matrix and visualize the different underlying distributions these time series may have. GNPR was shown to detect all underlying distributions more accurately than other methods, as it L2 distance, correlation distance, and GPR.

Implementation

- plot_time_series_dependencies(time_series, dependence_method='gnpr_distance', **kwargs)

-

Plots the dependence matrix of a time series returns.

Used to verify a time series’ underlying distributions via the GNPR distance method.

**kwargsare used to pass arguments to the get_dependence_matrix function used here.- Parameters:

-

-

time_series – (pd.DataFrame) Dataframe containing time series.

-

dependence_method – (str) Distance method to use by get_dependence_matrix

-

- Returns:

-

(plt.Axes) Figure’s axes.

Example

(Left) GPR codependence matrix. Only 5 correlation clusters are seen with no indication of a global embedded distribution. All 5 correlation clusters and 2 distribution clusters can be seen, as well as the global embedded distribution.

import matplotlib.pyplot as plt

from mlfinlab.data_generation.correlated_random_walks import generate_cluster_time_series

from mlfinlab.data_generation.data_verification import plot_time_series_dependencies

# Initialize the example parameters for the time series.

n_series = 200

t_samples = 5000

k_clusters = 5

d_clusters = 2

# Plot the time series and codependence matrix for each example.

# Generate a time series datasets with 2 underlying distributions that are clustered.

dataset = generate_cluster_time_series(n_series=n_series, t_samples=t_samples,

k_corr_clusters=k_clusters, d_dist_clusters=d_clusters,

dists_clusters=["normal", "normal", "student-t",

"normal", "student-t"])

plot_time_series_dependencies(dataset, dependence_method='gnpr_distance', theta=0.5)

plt.show()

Optimal Hierarchical Clustering

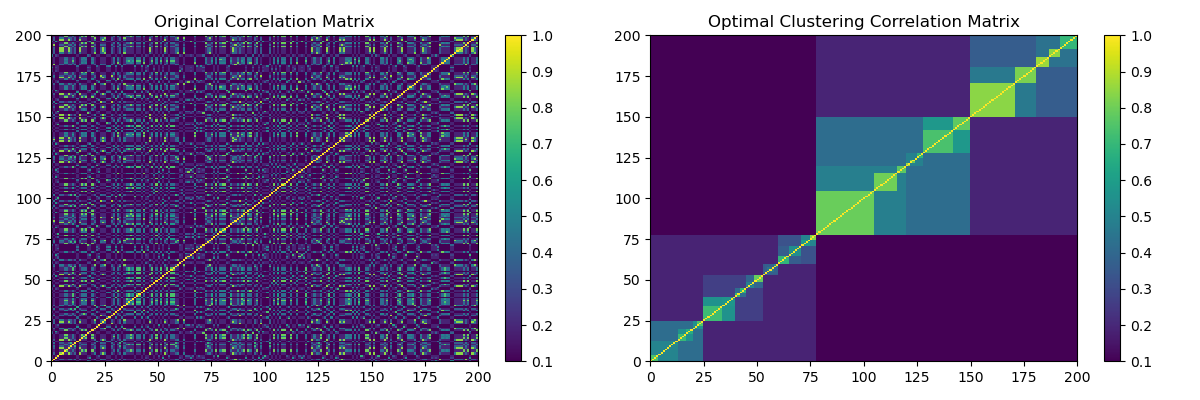

This function plots the optimal leaf hierarchical clustering as shown in Marti, G. (2020) TF 2.0 DCGAN for 100x100 financial correlation matrices by arranging a matrix with hierarchical clustering by maximizing the sum of the similarities between adjacent leaves.

Implementation

- plot_optimal_hierarchical_cluster(mat, method='ward')

-

Calculates and plots the optimal clustering of a correlation matrix.

It uses the optimal_hierarchical_cluster function in the clustering module to calculate the optimal hierarchy cluster matrix.

- Parameters:

-

-

mat – (np.array/pd.DataFrame) Correlation matrix.

-

method – (str) Method to calculate the hierarchy clusters. Can take the values [“single”, “complete”, “average”, “weighted”, “centroid”, “median”, “ward”].

-

- Returns:

-

(plt.Axes) Figure’s axes.

Example

(Left) HCBM matrix. (Right) Optimal Clustering of the HCBM matrix.

import matplotlib.pyplot as plt

from mlfinlab.data_generation.data_verification import plot_optimal_hierarchical_cluster

from mlfinlab.data_generation.hcbm import generate_hcmb_mat

# Initialize parameters

samples = 1

dim = 200

rho_low = 0.1

rho_high = 0.9

# Generate HCBM matrix

hcbm_mat = generate_hcmb_mat(t_samples=samples,

n_size=dim,

rho_low=rho_low,

rho_high=rho_high,

permute=True)[0]

# Plot it

plt.figure(figsize=(6, 4))

plt.pcolormesh(hcbm_mat, cmap='viridis')

plt.colorbar()

plt.title("Original Correlation Matrix")

# Plot optimal clustering.

plot_optimal_hierarchical_cluster(hcbm_mat, method="ward")

plt.title("Optimal Clustering Correlation Matrix")

plt.show()